permitted expenses for rental income malaysia

B wages salaries and allowances. A Assessment and Quit Rent Annual assessment Cukai Pintu paid half-yearly to local authority such as Dewan Bandaraya Kuala Lumpur and.

How To Start Airbnb In Malaysia Airbtics Airbnb Analytics

Adding together all your rental income.

. Classification of interest income Interest is classified as income under s4c of the Act together with dividends and discounts. What is the deductible expenses. 21 This PR takes into account laws which are in force as at the date this PR is published.

37 Interest expenses under the Guidelines excludes- a any interest expenses incurred in connection with the raising of finance eg. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. The Tenancy Agreement usually costs approximately 20 to 25 of the rental fees and it includes the Stamp Duty fees and administration charges.

Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service charge sinking fund and management fees are. Rental income is taxed at a flat rate of 24. To work out your profit or loss you should treat all receipts and expenses as one business even if youve more than one UK property by.

22 The provisions of the Income Tax Act 1967 ITA related to this PR are paragraphs 4a4d 4f. The monthly rental for each property is RM2000 or less. Nonresidents are taxed at a flat rate of 24 on their Malaysian-sourced income.

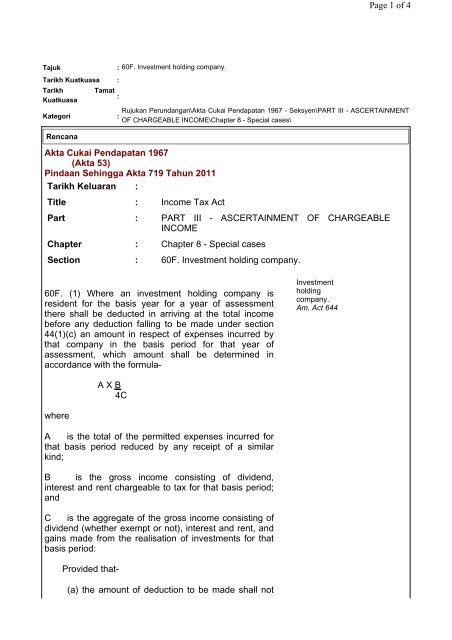

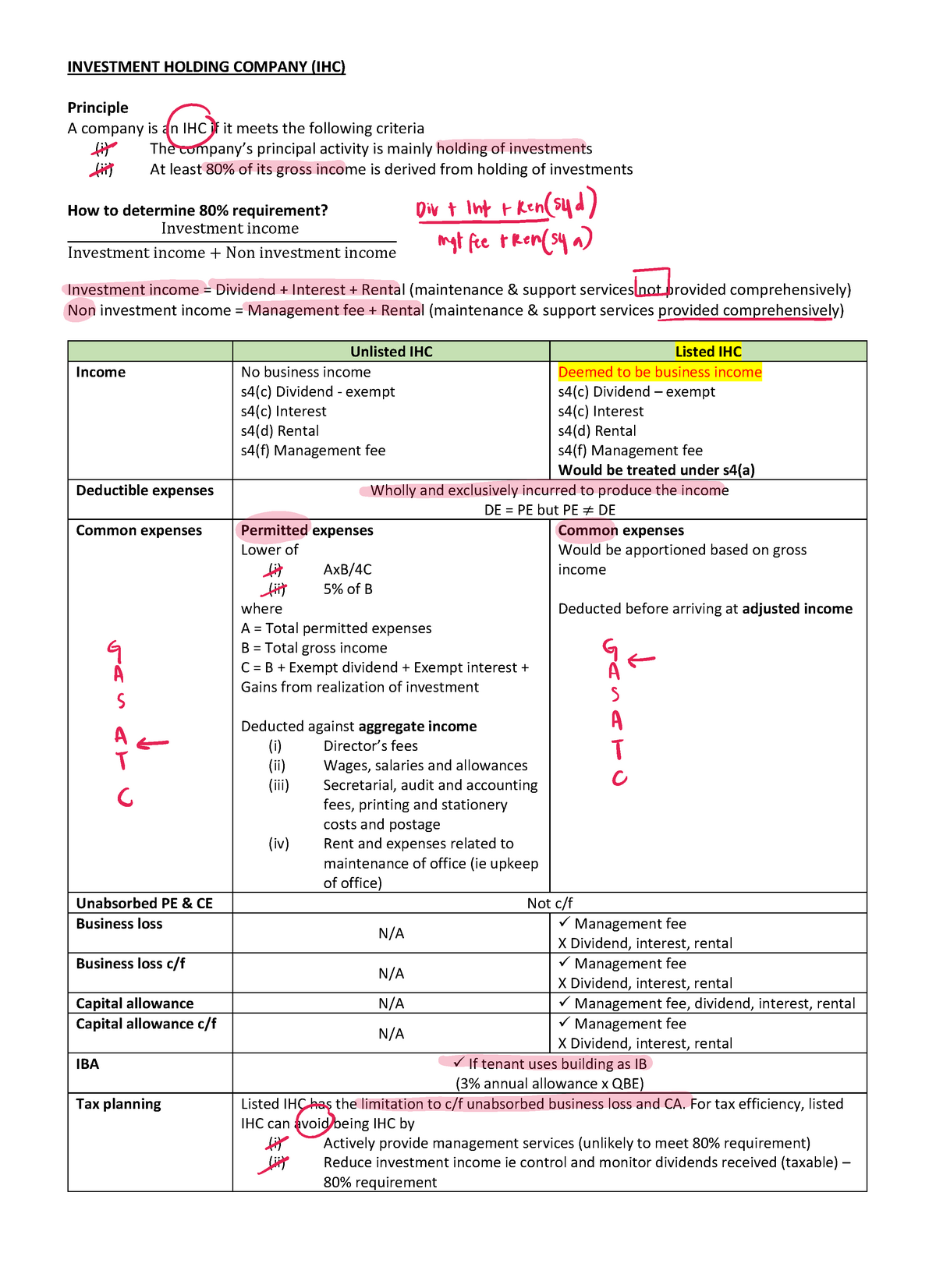

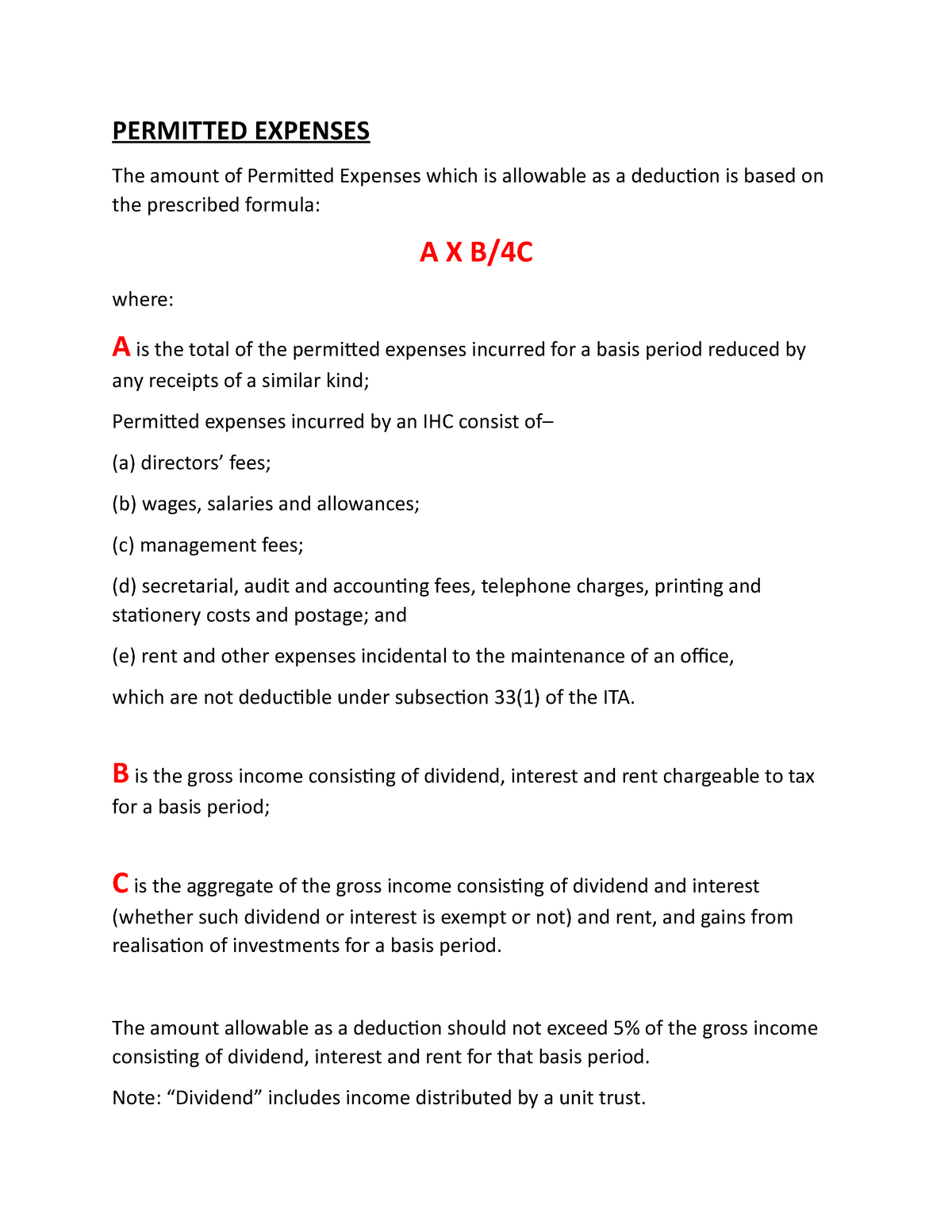

The rules provide that for the purpose of ascertaining the adjusted income from its business in a basis period for a year of assessment a company shall be allowed to deduct an. However interest is also capable of being classified as business. Governed under s60F of the income tax act 1967.

36 Rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. D secretarial audit and.

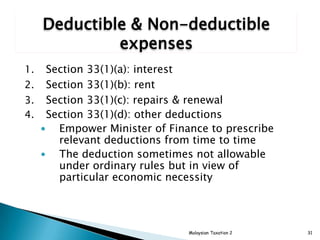

Any receipts of a similar kind. Rental Income Deductible Expenses. Expenses not wholly and exclusively incurred in the production of income domestic private or capital expenditure the company can claim capital allowance for capital expenditure incurred.

Or b any interest expenses. Permitted expenses incurred by an IHC consist of a directors fees. Tenancy takes place in.

B wages salaries and allowances. Not only has the corporate tax rate been decreased over the years the government has. IHC is allowed to claim a deduction for a certain portion of your administrative expenses such as directors fee wages.

The Income Tax Deduction for Expenditure on Provision of Employees Accommodation Rules 2021 PUA 4702021 Rules were gazetted on 24. The expenses that are income tax deductible including. 36 Rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in.

The tenancy agreement has to have been stamped and executed on or after January 1 2018. Permitted expenses means expenses incurred by an investment holding company in respect of- a directors fees. The Stamp Duty fees will be.

The rental income commencement date starts on the first day the property is rented out whereas.

Chapter 5 Corporate Tax Stds 2

Must You Declare Your Rental Income To Lhdn Landlord Tax Incentives Iproperty Com My

Ihc Advance Tax Malaysia Variant Warning Tt Undefined Function 32 Warning Tt Undefined Studocu

5 Things To Consider When Filing Taxes On Rental Income Free Malaysia Today Fmt

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

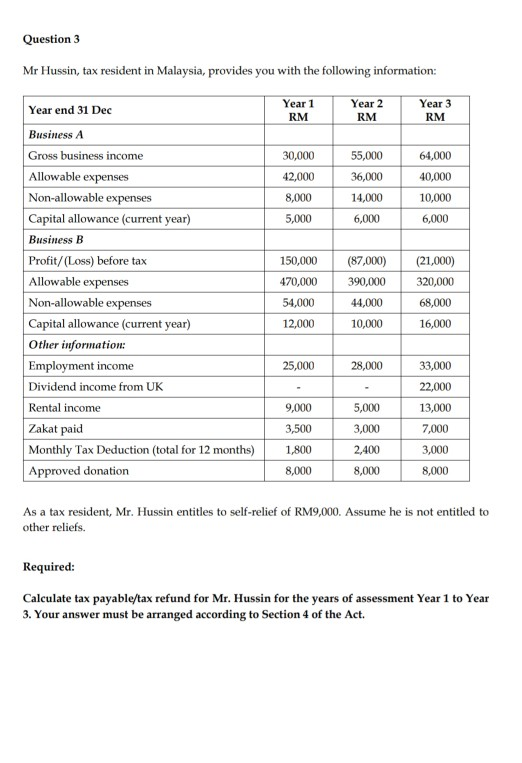

Solved Question 3 Mr Hussin Tax Resident In Malaysia Chegg Com

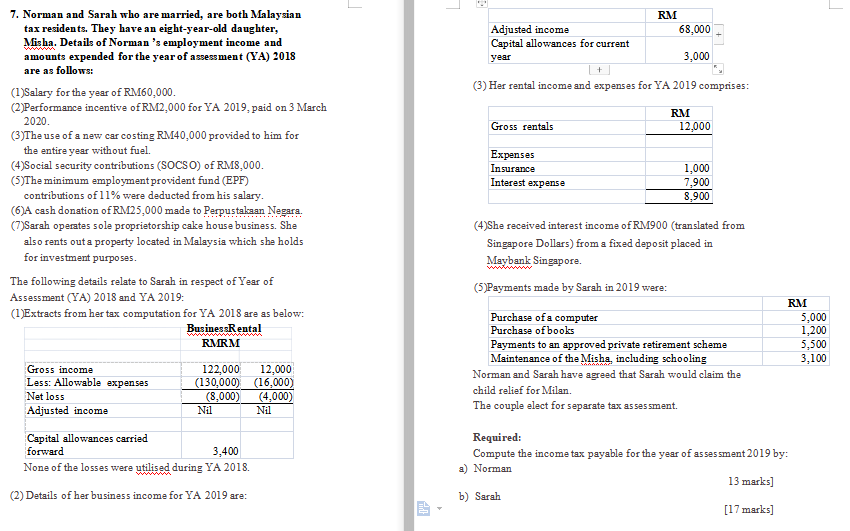

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Vacation Rental Income And Expense Tracking Template Short Etsy

What Are The Types Of Tax Treatment Imposed On Rental Income

Solved Norman And Sarah Who Are Married Are Both Malaysian Tax Residents They Have An Eight Year Old Daughter Misha Details Of Norman S Employ Course Hero

M Sian Landlords May Not Need To Declare Tax On Asklegal My

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

Permitted Expenses For Rental Income Malaysia Jaycectzx

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

5 Things To Take Note When Filing Tax On Rental Income Kclau Com

Formula Permitted Expenses Permitted Expenses The Amount Of Permitted Expenses Which Is Allowable Studocu

Comments

Post a Comment